When men and women hear about little one life insurance guidelines with versatile terms, they normally pause and wonder if it truly is smart to consider coverage so early in life. I get it, due to the fact childhood appears like a time that should be carefree, playful, and far from fiscal setting up. Nonetheless, existence has a humorous way of unusual us, and organizing forward can experience like planting a tree that provides shade afterwards. These insurance policies are not about expecting the worst, but about planning wisely. They will present relief, long-term price, and a safety Internet that grows alongside your son or daughter. When you concentrate on it, giving your son or daughter a money Basis early can really feel like offering them a head start in a protracted race.

One of the largest causes parents consider youngster lifestyle insurance plan guidelines with versatile conditions would be the adaptability they offer. Existence changes frequently, like a river that in no way flows precisely the same way twice. Versatile conditions imply you are not locked into rigid regulations that no more fit your family situation. You could begin with a modest approach and alter it later as your income grows or as your child reaches new milestones. This overall flexibility can feel like getting a jacket that still fits even though the weather alterations. As opposed to scrambling to adjust later, you have already got solutions constructed in to the plan from the beginning.

Yet another angle worth Discovering is how these guidelines can lock in insurability at a young age. Young ones are commonly balanced, and that may get the job done with your favor. With little one lifetime insurance policy policies with flexible phrases, you often protected coverage in advance of any health concerns arise. Imagine it like reserving a seat at a well-liked clearly show prior to it sells out. Later in life, if your child develops health conditions, they should have usage of protection that may normally be pricey or limited. This part by yourself is usually comforting for folks who would like to safeguard their baby potential selections.

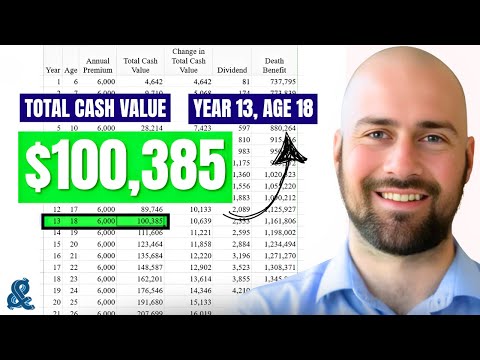

Persons also mention the savings component that often includes little one lifestyle insurance policies insurance policies with flexible conditions. Though not just about every coverage works exactly the same way, some Construct money value as time passes. This tends to experience just like a quiet personal savings account rising from the background while you focus on everyday life. Over the years, that hard cash worth could possibly be useful for training, beginning a business, or dealing with unanticipated expenditures. It's not about receiving loaded swiftly, but about regular expansion. Like seeing a plant increase, it needs patience, but the long term payoff might be significant.

About Insurance For Professional Speakers And Presenters

There's also an emotional facet to consider. Choosing child life insurance policy insurance policies with flexible conditions can provide mom and dad a sense of Handle in an unpredictable planet. Parenting frequently looks like juggling too many balls at once, and obtaining one particular less worry will make a huge big difference. Understanding you have set a little something in spot for your son or daughter upcoming can bring a tranquil perception of aid. It is similar to buckling a seatbelt, not as you hope a collision, but since you benefit basic safety and preparedness.

There's also an emotional facet to consider. Choosing child life insurance policy insurance policies with flexible conditions can provide mom and dad a sense of Handle in an unpredictable planet. Parenting frequently looks like juggling too many balls at once, and obtaining one particular less worry will make a huge big difference. Understanding you have set a little something in spot for your son or daughter upcoming can bring a tranquil perception of aid. It is similar to buckling a seatbelt, not as you hope a collision, but since you benefit basic safety and preparedness.Some critics argue that parents need to emphasis by themselves insurance policies initial, and that time isn't Improper. Nonetheless, boy or girl lifestyle coverage procedures with adaptable phrases do not need to compete with adult protection. Rather, they're able to enhance it. Think about All your family members economical system to be a puzzle, wherever each bit has its position. Adult insurance policies covers earnings substitute and house steadiness, even though boy or girl guidelines focus on upcoming security and prospect. Together, they will create a a lot more complete picture that supports The complete family members.

Another critical component is affordability. Quite a few dad and mom are shocked to learn that little one lifetime insurance policies procedures with adaptable terms is usually reasonably inexpensive. Setting up early often means reduce rates, which can healthy far more simply right into a every month spending plan. It can be like buying a ticket early and paying out lower than in the event you waited until the last minute. After a while, People smaller payments can incorporate as much as substantial Added benefits. This affordability can make it less complicated for family members from different economical backgrounds to look at this feature.

Flexibility also extends to Unlock Insights Quickly just how long the policy lasts. Little one life insurance coverage insurance policies with adaptable terms may possibly allow conversion to adult policies afterwards. This function can truly feel just like a bridge amongst childhood and adulthood, making certain continuity of coverage. When your child grows up, they might not have to have to get started on from scratch. As an alternative, they can carry forward a policy which has been with them For some time. This continuity is often Primarily beneficial for the duration of early adulthood, when funds can be restricted and priorities are still forming.

Mothers and fathers generally request if these procedures are seriously necessary. That query is organic, and The solution is determined by particular values and goals. Youngster everyday living insurance policy insurance policies with flexible phrases are usually not a 1 measurement suits all Option. For some people, they make ideal feeling, while others may perhaps select different approaches. What matters is understanding the choices and earning an knowledgeable option. It really is like choosing the proper Resource for just a job. You'd like something that suits your needs, not just what everyone else is applying.

Education setting up is an additional area where these insurance policies can Enjoy a job. Some dad and mom use the money worth from child lifetime coverage procedures with flexible conditions that will help fund college or coaching plans. Whilst it must not change other instruction discounts ideas, it may function a further useful resource. Consider it being a backup generator that kicks in when required. Obtaining several alternatives Find Fast Info can lessen pressure and provide flexibility when huge charges arrive.

There's also the concept of instructing economical responsibility. By creating little one everyday living coverage guidelines with adaptable terms, parents can afterwards entail their small children in being familiar with how the coverage will work. This can be a gentle introduction to financial principles like conserving, fascination, and long term preparing. It is comparable to training a baby tips on how to ride a bike, setting up with coaching wheels and direction. With time, they get self-confidence and know-how that may serve them effectively into adulthood.

From the chance administration standpoint, these guidelines supply protection against unusual but devastating situations. No mum or dad wants to consider getting rid of a youngster, but obtaining youngster everyday living insurance policy procedures with flexible phrases can assist go over healthcare payments, funeral prices, or day off function In case the unthinkable comes about. It is not about putting a selling price over a daily life, but about decreasing fiscal pressure in the course of an currently painful time. In that perception, the coverage acts like a cushion, softening the affect of Unlock Updates Quickly a tough drop.

Supplemental Insurance For Medical Emergencies Things To Know Before You Get This

Some family members also respect the predictability these procedures carry. With little one lifetime insurance policy policies with versatile terms, you often know What to anticipate with regards to premiums and Added benefits. This predictability may make budgeting less complicated and cut down surprises. Everyday living is currently full of unknowns, so owning a single space that feels steady is often comforting. It's like possessing a trusted clock to the wall, often ticking at precisely the same rate.Cultural and private beliefs also Engage in a role in how persons watch child everyday living coverage guidelines with versatile conditions. In a few family members, setting up forward is deeply ingrained, while some prefer to deal with the present. Neither strategy is inherently right or wrong. What issues is aligning your possibilities together with your values. If you think in creating a basic safety net early, these procedures can align very well with that attitude and help your long-term vision for your family.